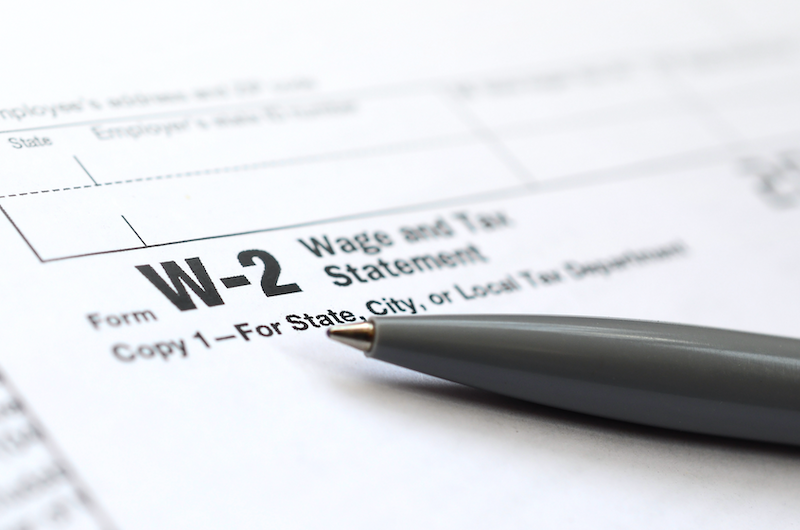

IRS Publishes Draft Revised Form W-2 for 2026

The One Big Beautiful Bill Act (OBBBA) requires employers to include on the Form W-2: (a) the total amount of cash tips reported by the employee, as well as the employee’s qualifying tipped occupation; and (b) the total amount of qualified overtime compensation.

On August 7, 2025, the IRS announced that Form W-2 would remain unchanged for tax year 2025. However, more guidance from the IRS is expected in the coming weeks.

For 2026 tax year, the IRS has published a draft of the 2026 W-2. The IRS publication emphasizes that this is an “early release draft” and that additional changes may be forthcoming before it is finalized for use.

One, Big, Beautiful Bill Act: Tax Deductions for Working Americans and Seniors